The real reason Enron flopped on Broadway? | reviews, news & interviews

The real reason Enron flopped on Broadway?

The real reason Enron flopped on Broadway?

Thursday, 06 May 2010

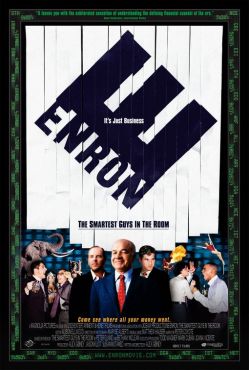

This week, after a performance of Enron at the Noel Coward Theatre, I chaired a Q&A session with director Rupert Goold, writer Lucy Prebble, actor Sam West and most of the rest of the cast. What no one in the room knew then, though Goold and Prebble would have, was that at 11pm EST the show’s Broadway closure would be announced for this Sunday, only two weeks after it opened on 27 April. Enron was famously a rare beneficiary of the credit crunch. Now, at least in America, it would appear to have become a victim of it. Why?

The play had been sitting on the backburner of the theatre company Headlong for a couple of years when Lehman Brothers collapsed, and with it the world economy. Enron was hastened into the season at Chichester last summer. It swiftly moved to the Royal Court and then this year onto the West End. With deservedly great reviews and sell-out audiences, its journey to Broadway was written in the stars.

The play had been sitting on the backburner of the theatre company Headlong for a couple of years when Lehman Brothers collapsed, and with it the world economy. Enron was hastened into the season at Chichester last summer. It swiftly moved to the Royal Court and then this year onto the West End. With deservedly great reviews and sell-out audiences, its journey to Broadway was written in the stars.How could New York not receive a such a brilliant and urgent play when it takes so much else from London? Just look at the nominations for this year’s Tonys. Even Enron secured four - but crucially in none of the box-office stimulant categories of best play, best director and best actor: it was oddly nominated for best original score. Thanks to the Darwinian sink-or-swim economics of Broadway, without that industrial underpinning there was only one fate for Enron.

On Tuesday evening the cast answered questions about the play’s genesis, the need or otherwise to understand complex financial instruments in order to perform in it, the motivation of Jeffrey Skilling, the influence of Jurassic Park and the great American musical. And so on. And then at the end came a question about the run on Broadway. “The play has opened in New York: how has it been received?”

Prebble, irrepressible as ever, was quick to answer. “Rupert,” she said. Handed this hospital pass, Goold launched into an answer about the difficulty of selling a play about money to an audience which culturally has an entirely different relationship with acquisitiveness to our own.

West, who had no part in the Broadway production, joined in. The last line of the play is “And the greatest of these is money!” How shocking it must be, he more or less said, for American audiences to hear Christ's quotation from Deuteronomy mis-invoked in the name of an anti-capitalist satire against a god New Yorkers pretty much unquestioningly worship. Prebble joined in, talking about the largely Democrat New York audiences reacting uncomfortably to a play about rampant Republican free-marketeering at a time when President Obama is trying to reform the banking system.

I’ve got my own theory. American audiences love us reinventing their musicals like current Broadway hits A Little Night Music and La Cage aux Folles, love our theatrical investigations of American subjects such as Mark Rothko in Red, all of them copiously nominated. They love English subjects too as enshrined in plays like The History Boys. They loved Jude Law in Hamlet. But they just won’t stomach being told off by a British writer (and, although I didn’t say this onstage, a young female one at that: Prebble is not yet 30). Lest we forget, there is not a single redeeming character in Enron. And every single one of them is American. When I asked a potted version of this question, Goold publicly doubted that had anything to do with it. Afterwards I put it to Prebble. She nodded vigorously.

- Enron's run at the Noel Coward Theatre, London, has been extended to 14 August

- The Broadway production of Enron, in spite of winning four Tony nominations, closed 9 May

Share this article

more

Album: Dua Lipa - Radical Optimism

An admirable attempt to catch the magical groove that helped us through lockdown.

Album: Dua Lipa - Radical Optimism

An admirable attempt to catch the magical groove that helped us through lockdown.

Laughing Boy, Jermyn Street Theatre review - impassioned agitprop drama

Strong ensemble work highlights the plight of people with learning disabilities

Laughing Boy, Jermyn Street Theatre review - impassioned agitprop drama

Strong ensemble work highlights the plight of people with learning disabilities

Guildhall School Gold Medal 2024, Barbican review - quirky-wonderful programme ending in an award

Ginastera spolights the harp, Nino Rota the double bass in dazzling performances

Guildhall School Gold Medal 2024, Barbican review - quirky-wonderful programme ending in an award

Ginastera spolights the harp, Nino Rota the double bass in dazzling performances

Album: Sia - Reasonable Woman

An awesome singer-songwriter comes into her own

Album: Sia - Reasonable Woman

An awesome singer-songwriter comes into her own

Minority Report, Lyric Hammersmith Theatre review - ill-judged sci-fi

Philip K Dick’s science fiction short story fares far better on screen

Minority Report, Lyric Hammersmith Theatre review - ill-judged sci-fi

Philip K Dick’s science fiction short story fares far better on screen

Mitski, Usher Hall, Edinburgh review - cool and quirky, yet deeply personal

A stunningly produced show from one of pop’s truly unique artists

Mitski, Usher Hall, Edinburgh review - cool and quirky, yet deeply personal

A stunningly produced show from one of pop’s truly unique artists

Album: EYE - Dark Light

New band from MWWB singer Jessica Ball prove worthy of what came before

Album: EYE - Dark Light

New band from MWWB singer Jessica Ball prove worthy of what came before

Two Strangers (Carry A Cake Across New York), Criterion Theatre review - rueful and funny musical gets West End upgrade

A Brit and a New Yorker struggle to find common ground in lively new British musical

Two Strangers (Carry A Cake Across New York), Criterion Theatre review - rueful and funny musical gets West End upgrade

A Brit and a New Yorker struggle to find common ground in lively new British musical

Queyras, Philharmonia, Suzuki, RFH review - Romantic journeys

Japan's Bach maestro flourishes in fresh fields

Queyras, Philharmonia, Suzuki, RFH review - Romantic journeys

Japan's Bach maestro flourishes in fresh fields

Nadine Shah, SWG3, Glasgow review - loudly dancing the night away

The songstress offered both a commanding voice and an almost overwhelming sound.

Nadine Shah, SWG3, Glasgow review - loudly dancing the night away

The songstress offered both a commanding voice and an almost overwhelming sound.

Expressionists: Kandinsky, Münter and the Blue Rider, Tate Modern review - a missed opportunity

Wonderful paintings, but only half the story

Expressionists: Kandinsky, Münter and the Blue Rider, Tate Modern review - a missed opportunity

Wonderful paintings, but only half the story

Blu-ray: The Dreamers

Bertolucci revisits May '68 via intoxicated, transgressive sex, lit up by the debuting Eva Green

Blu-ray: The Dreamers

Bertolucci revisits May '68 via intoxicated, transgressive sex, lit up by the debuting Eva Green

Add comment